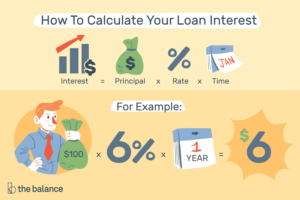

How Loan Interest Rates Work

Interest rates are an integral component of the cost of borrowing money. High rates make purchases such as houses, cars or vacations more costly – it’s therefore vital for borrowers to understand how interest works so that they can compare different loan offers and find one best-suited to their financial needs.

Loan interest rates

Lenders make money through interest charges and fees, and set their interest rates according to the amount of risk associated with each individual loan or debt they take on – known as the “cost plus” approach for loan pricing. A variety of factors, including funding and operating costs as well as profit margin target are taken into consideration in setting interest rates on new loans or debts from lenders; lending standards, market competition and potential risk are also influential when setting interest rates on loans or debts from different lenders.

Creditworthiness of borrowers is usually the main determinant of loan interest rates, with higher scores often receiving lower rates as lenders assume they will be less likely to default. Furthermore, they may consider factors like their employment status and income when making this determination.

Loan interest rates depend not only on a borrower’s creditworthiness but also upon the type and length of their loan agreement. Longer-term loans generally carry lower interest rates because lenders have more time to earn income from them; however, longer-term loans carry increased risks because it involves capital being tied up for longer and cannot be invested elsewhere for return of profit.

How Loan Interest Rates Work

When comparing loan rates, it’s essential to keep in mind that interest rates are typically stated in terms of annual percentage rates (APR), while yields on savings accounts and certificates of deposit may be given in terms of annual percentage yields instead. Although APRs can more effectively express borrowing costs, yields provide more accurate description as they take compounding into account.

Personal loans involve annual percentage rates (APR), which take into account any additional fees associated with them. Some lenders advertise loans without origination or other charges – these may often be less costly – so it is essential for borrowers to evaluate all loan options carefully to make sure they are comparing apples-to-apples, otherwise they risk paying more than necessary for whatever it is they need money for. It is advisable for borrowers to shop around and compare official Loan Estimates from various lenders prior to making their final decision.